In today’s evolving workforce, contractors, freelancers, and consultants are no longer the exception — they’re the norm. From short-term projects to specialised roles, businesses increasingly rely on flexible talent. But while hiring contractors is easy, managing their payments and compliance often isn’t.

Spreadsheets, manual calculations, and disconnected systems can quickly turn contractor payroll into a time‑consuming and error‑prone process. This is where a structured payroll solution makes a real difference.

The Challenge with Contractor Payroll

Many organisations still manage contractors outside their core payroll system. This typically leads to:

- Scattered contractor data across tools and files

- Manual payment calculations and TDS tracking

- Limited visibility into payment history

- Increased risk of compliance gaps

- Extra administrative effort for HR and finance teams

As businesses scale or work with multiple contractors, these challenges only multiply.

A Smarter Way to Manage Contractors

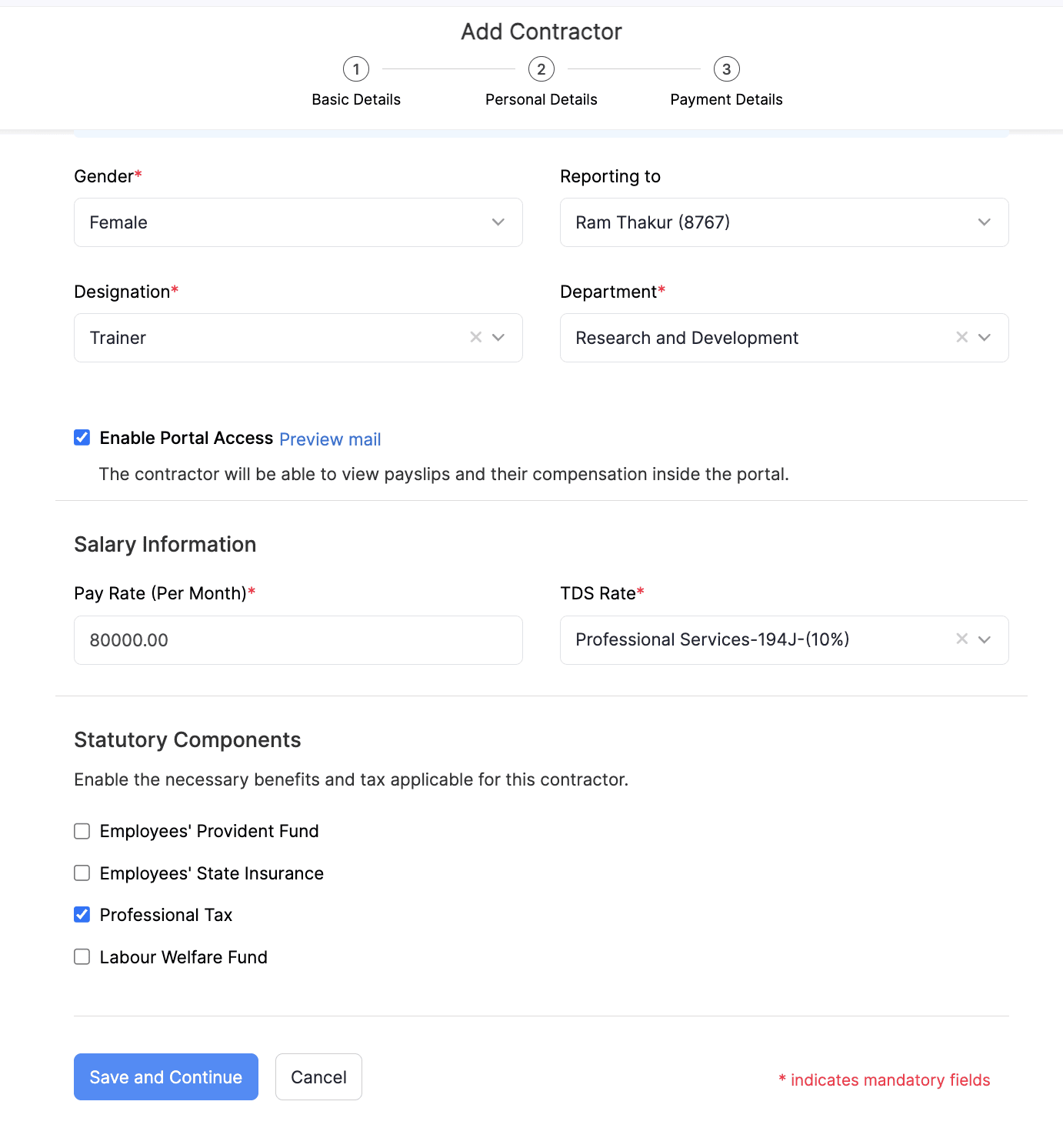

With Zoho Payroll, contractor management becomes part of a single, unified payroll ecosystem — alongside your employees.

Instead of juggling multiple systems, businesses can manage everything from one place.

Key Capabilities

Why Implementation Matters

Payroll software delivers real value only when it’s implemented correctly. A well‑planned implementation ensures:

This is where the right implementation partner plays a crucial role.

How We Help

We specialise in end‑to‑end Zoho Payroll implementation, helping businesses set up and manage contractor payroll with confidence. Our approach includes:

- Understanding your contractor and payroll structure

- Configuring Zoho Payroll to match your requirements

- Setting up contractor profiles, payments, and compliance rules

- Go‑live support and post‑implementation assistance

The result is a payroll system that works the way your business works — efficient, compliant, and easy to manage.

Final Thoughts

As contractor‑based work continues to grow, managing payroll the right way becomes critical. Bringing contractors into a structured payroll system not only reduces administrative overhead but also improves accuracy, visibility, and compliance.

If contractor payroll feels complex today, it may be time to simplify it with Zoho Payroll — and a trusted implementation partner to guide you every step of the way.

Want help implementing Zoho Payroll for your contractors? Get in touch with us to start the conversation.